by Kevin Lewis, Former CFO, Physician Housecalls

Though it may seem like only a small cloud on the horizon today, value-based care (VBC) will be here sooner than you think. CMS aims to transition all dollars expended for Medicare, Medicare Advantage, and Medicaid beneficiaries to value-based payments by 2030. That’s a very big deal when you consider that Medicare and Medicaid payments have provided nearly half of the revenues for hospital-owned multispecialty medical groups —and account for 32% of hospital revenues.

For healthcare providers, transitioning from fee-for-service to VBC arrangements requires a willingness to accept varying degrees of financial risk. Shared-savings and shared-risk models involve moderate financial risk, while capitation and capitation + performance-based contracting involve a large percentage of risk.

How do you minimize that risk and maximize your opportunities both to thrive financially and deliver better care to your patients?

It starts with capturing and applying information. Data-driven insights are vital to value-based care and the vitality of healthcare provider groups. More specifically, understanding all the health conditions associated with your patients, and then using that information to apply diagnosis codes accurately, will become more critical than ever.

The most important data point to know is the RAF (Risk-Adjusted Factor) score, which incorporates the various components needed to provide an overall health profile of the patient and predict the total cost of care. Payors then use the RAF score to calculate payments to provider organizations.

RAF scoring begins with accurate and complete ICD-10 diagnosis capture, which is combined into HCCs (Healthcare Condition Categories). HCCs are sets of medical codes linked to specific clinical diagnoses involving chronic and severe acute health conditions. CMS has established 115 HCCs linked to payments, along with 7,770 payment-linked ICD-10 codes within the HCCs.

To arrive at an RAF score, payors assign a relative factor to each HCC associated with a patient. Then they average it with other HCC code factors, plus additional demographic-related health factors (such as age and gender). Under a capitated reimbursement arrangement, payors multiply the RAF score by a predetermined dollar amount to determine reimbursement.

Since sicker patients with higher HCC scores typically require more treatment, providers under a value-based system receive higher reimbursement rates to care for these patients. That’s why capturing the correct codes and providing a complete picture of the patient’s health directly relates to your organization’s financial health.

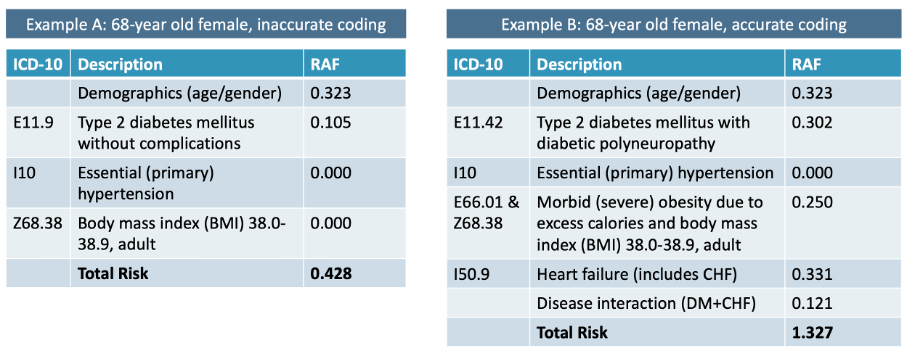

Here’s an illustration involving a 68-year-old female patient who suffers from Type 2 diabetes and hypertension.

(The above data is merely illustrative and does not reflect actual RAF scores.)

In the graphic on the left, incomplete (inaccurate) coding produces an RAF score of 0.428. An accurately coded record (graphic at right) shows a complicating condition related to the patient’s diabetes, a fuller picture of her weight and body mass index, and heart failure that was entirely missed in the incomplete record.

Adding more data to provide accurate coding results in a risk score three times higher than the incomplete record, translating into a much higher expected cost of care and higher reimbursement.

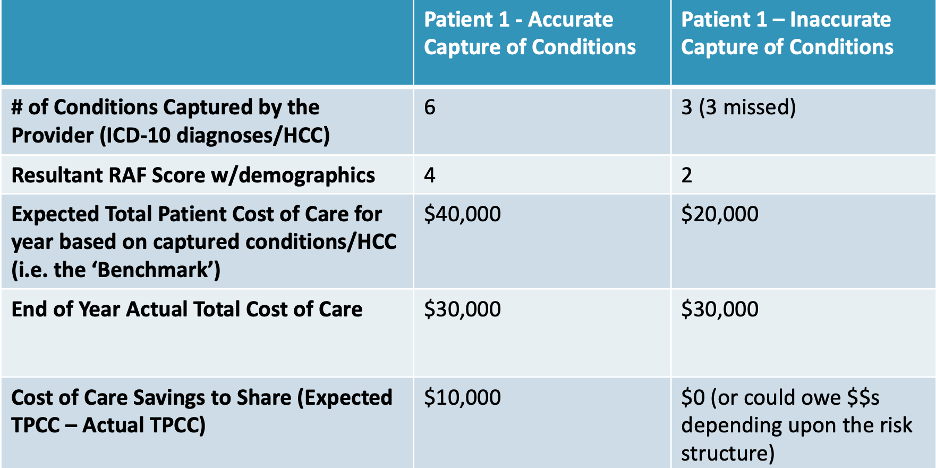

How much more? Here’s another example:

(The above data is merely illustrative and does not reflect actual RAF scores or reimbursements.)

In this scenario, accurately capturing all six of this patient’s conditions via ICD-10 diagnoses and HCC codes, instead of just noting three conditions, results in annual cost-of-care savings of $10,000, while inaccurate coding and incomplete data could create a net loss of $10,000.

The lesson here is not that providers should fear the financial risks that come with value-based payment models. Rather, it’s that accurate coding of all diagnoses translates into accurate risk assessment and offers significant rewards for healthcare organizations and physicians while helping patients avoid hospitalizations and other expensive treatments.

Kevin Lewis is Senior Vice President, Finance and Value-Based Care for Calm Waters AI and formerly served as Chief Financial Officer for Physician House Calls, a large specialty provider group headquartered in Oklahoma.

Ready to enhance revenue cycle performance and help ensure that providers’ medical documentation is complete and “bulletproof” before it leaves their desktops? View a demo of Calm Waters AI and learn more about our documentation improvement services with ChartPal.